This month marks a big milestone for Conor, seven years at Mascolo & Styles. As Relationship Manager, Conor brings a calm, organised approach to everything he does.

Read MoreWe are absolutely thrilled to announce that James has successfully passed his AAT Level 4 Diploma in Professional Accounting!

Read MoreWe are incredibly proud to announce that Tom has officially passed his AAT Level 3 Diploma in Accounting!

Read MoreInstead of our traditional Secret Santa this year, the Mascolo & Styles team decided to do something a little different.

Read MoreFrom all of us at Mascolo & Styles, we’d like to wish our clients a very happy Christmas and a healthy, successful New Year.

Read MoreWe’re proud of how our team came together to support the Southampton Toy Appeal this year.

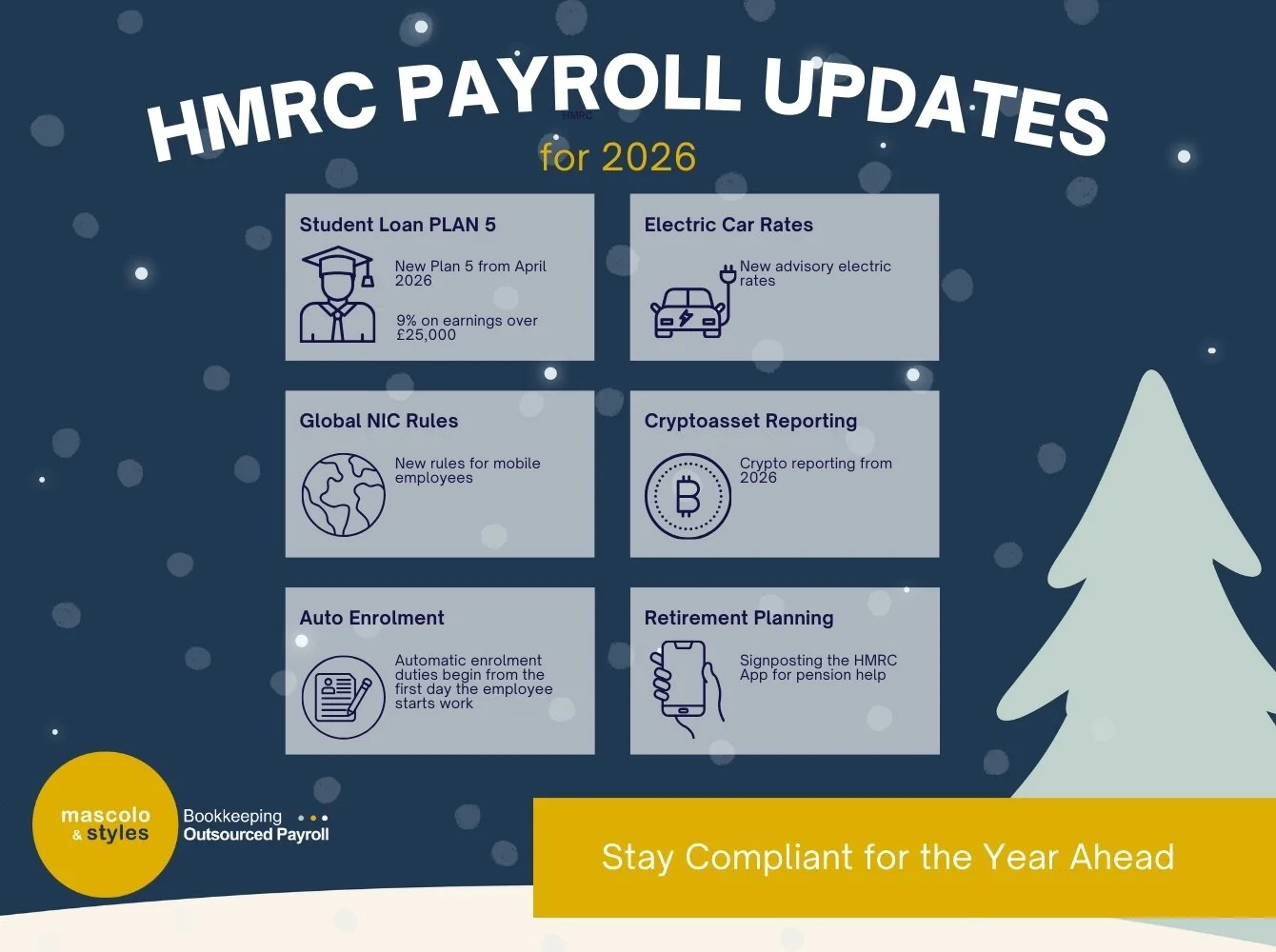

Read MoreStay compliant before the 2025/26 tax year. Discover key HMRC payroll updates on Student Loan Plan 5, EV mileage rates, NICs for mobile staff, and crypto reporting.

Read MoreThe Department for Work and Pensions (DWP) has published its policy paper detailing the benefit and pension rates for the 2026/27 tax year, and the information contains crucial updates that will significantly impact payroll administration and employer costs.

Read MoreThe way UK businesses report and tax employee Benefits in Kind (BiKs) is set for its most significant change in decades. HMRC has confirmed that mandatory payrolling of most BiKs will commence on 6 April 2027.

Read MoreAn overview of the Autumn Budget 2025 and how it impacts Payroll.

Read MorePrepare your payroll for the UK's Employment Rights Bill in 2026. Discover the key changes, from Day 1 parental leave and SSP reforms to the ban on fire and rehire.

Read MoreThe ONS has released its latest “Labour market overview, UK: October 2025” bulletin, covering the three-month period June to August 2025. We’ve pulled out the key points and what they mean for organisations managing staffing, pay and compliance.

Read MoreLearn what your P45 is, why it matters, and how to use it when you leave a job. Our guide explains each section of the form and answers common questions about tax, pay, and future employment.

Read MoreThe ONS reported this month that the UK labour market shows continued cooling, with job losses in sectors like hospitality and retail, falling job vacancies, and slowing wage growth.

Read MoreAs National Payroll Week (UK) approaches from September 1st to 5th, 2025, we're taking this opportunity to shine a spotlight on our incredible payroll team!

Read MoreManaging payroll can be complex, time-consuming, and costly if not done right. Whether you're a growing business looking to streamline operations or you're simply not satisfied with your current provider, it might be time to explore your options. We've put together a free guide to help you evaluate whether outsourcing payroll is right for you.

Read MoreSwitching payroll providers can feel like a big job-especially if you’re used to your current system. But in reality, changing payroll providers doesn’t have to be complicated or stressful. With the right preparation and understanding of the process, you can make the switch smoothly and get your business on the path to better payroll management.

Read MoreKeeping In Touch days, or KIT days, provide a flexible way for employees on maternity leave to stay connected with their workplace without losing their maternity pay. For employers and payroll teams, understanding KIT days is important to handle payroll correctly and support your workforce effectively.

Read MoreEmployers and payroll professionals granted extra year to prepare for major tax reporting change. The government has officially delayed the introduction of mandatory payrolling for benefits in kind (BiKs) to 6 April 2027, providing stakeholders with an additional year to prepare.

Read MoreWhen reviewing your payslip, you might notice letters next to your National Insurance category or tax code. These letters represent specific categories that help determine how much tax and National Insurance you pay.

Read More