Payroll Accounting Services

What is payroll accounting?

Payroll accounting is the calculation, recording, analysis and distribution of employees earnings. The calculations are based on salary along with other types of payment accrued during the course of an employees work.

What is the difference between accounting and payroll accounting?

Accounting is the process of recording, organising, measuring and evaluating a business and its financial information. Payroll accounting relates to the process of recording, organising measuring and evaluating employees salary, holiday pay, sick pay, paternity, and maternity pay.

Payroll accounting

As an employer you are responsible for the accurate recording of National Insurance Contributions and Income Tax your employees owe HMRC.

Payroll costs

When calculating payroll the following must be accounted for:

· The employee (wages)

· HMRC (Income Tax and National Insurance Contributions)

· Pension Providers (deductions for pensions)

· Voluntary Deductions (charities, trade unions)

PAYE (Pay as you Earn) Income Tax

For the 2021/22 tax year the standard income band tax rates for PAYE employees are:

UK National Insurance (NI)

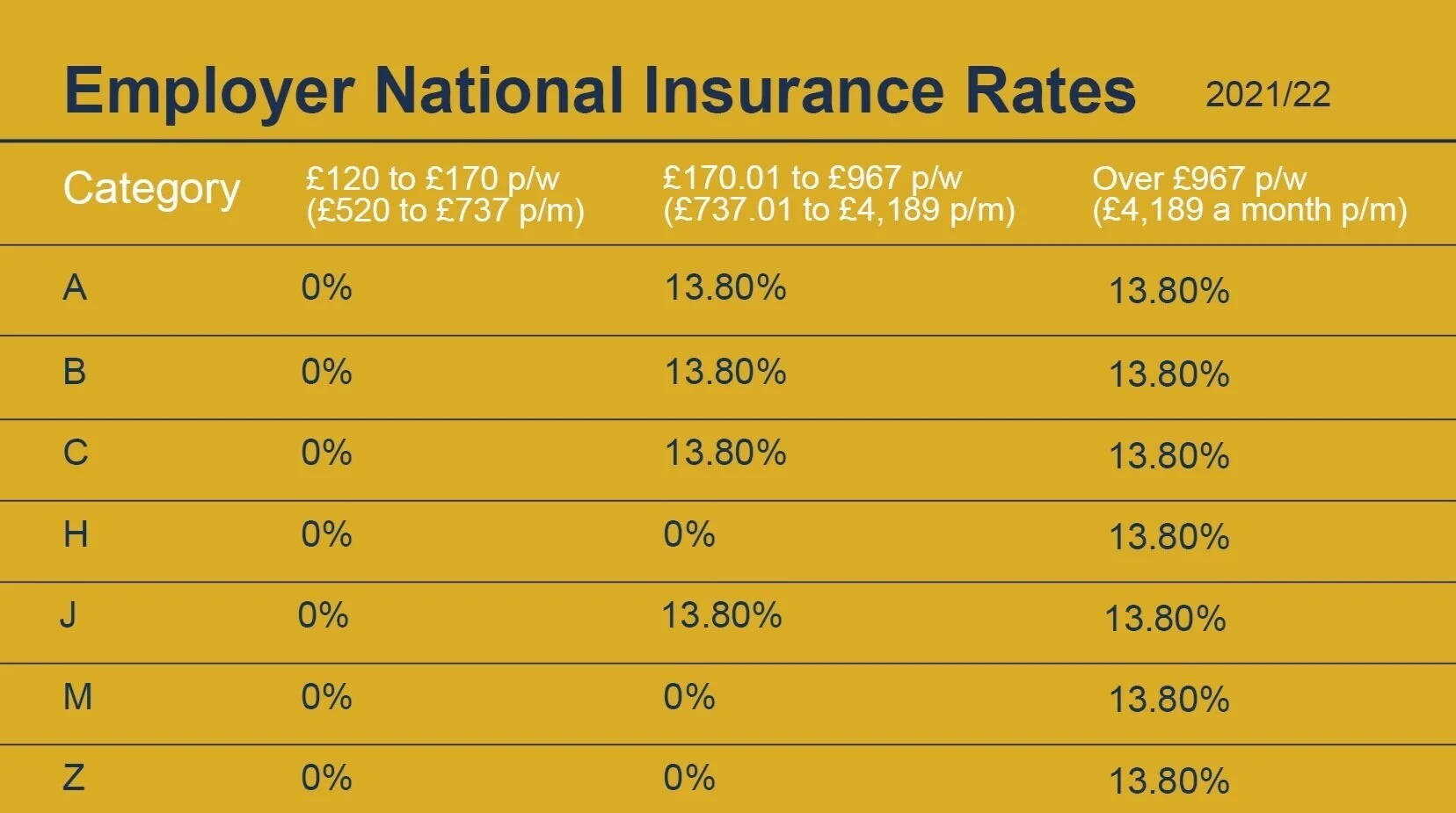

Employees and employers pay Class 1 National Insurance contributions. Employers deduct this amount from employees’ gross salary. The amount paid depends on the employees NI category letter and income band. For the 2021/22 tax year the standard rates are:

There are different rates for Company Directors, Landlords, Share Fishermen, and the self-employed. Self employed or ‘sole traders’ file a self assessment - a system used by HM Revenue and Customs (HMRC) to calculate tax on your income.

The Government’s Employment Allowance scheme allows some companies to reduce their employers’ Class 1 National Insurance liability by up to £4000 each tax year. Business or charities (including community amateur sports clubs) with employers’ Class 1 National Insurance liabilities below £100,000 in the previous tax year are eligible to claim.

Auto Enrolled pension

All employers must offer a pension scheme. As an employer you must automatically enrol employees age over 22 with a salary of at least £10,000 per year into a pension scheme. The employee has the option to ‘opt out’, with any contributions collected refunded within the first calendar month. The pension provider could be a state backed pension scheme, such as Nest.

There are varying methods of contribution – deductions for pensions are calculated by the payroll management team.

Student Loan

University students that have taken out a loan from the government to help pay for tuition fees and living costs have to repay the loan when they start working. Once an employee reaches a specific salary threshold they are required to pay back a percentage of the amount borrowed – this is paid as a payroll deduction from gross pay.

Payroll accounting journals

A payroll journal is used to record a movement of an amount from one nominal account to another. Journal entries are used to reflect the costs and liabilities of a business. Payroll accounting requires posting double entries in the journal for several calculations:

o Costs in the profit & loss account (salaries, pension contributions and Employers NI)

o Liabilities on the balance sheet (net wages payable, PAYE and Pensions control account).

Keeping up to date with the current rates and legislation can be a time consuming and expensive process - for many UK business they choose to outsource payment accounting to a specialist payroll company.